The Disclosure system of third-party funding in international commercial arbitration

Introduction

Third-Party Funding (TPF) refers to the provision of financial assistance by a third party unrelated to the parties involved in arbitration to one of the parties before or during the arbitration process.If the funded party prevails, the third party is entitled to receive a certain percentage of the remuneration. Third-party funding is considered an investment in international commercial arbitration. On one hand, it can alleviate the difficulties faced by parties in participating in international commercial arbitration due to financial constraints. On the other hand, it may increase the number of speculative cases, potentially endangering procedural justice and even triggering legitimacy crises in international commercial arbitration. Establishing rules for disclosing commercial arbitration can to a certain extent mitigate the issues such funding may cause, such as harm to the host country's interests and conflicts of interest. The evaluation of TPF varies among countries in theory and practice, and different arbitration institutions have different regulations on this issue. Therefore, it is necessary to focus on the arbitration rules of various arbitration institutions and combine existing arbitration case practices to analyze the disclosure system for third-party funding in detail.

I. Reasons for the Emergence of Third-Party Funding Disclosure System in Commercial Arbitration

Third-party funding is an investment activity, and for third-party funders, their main purpose in participating in arbitration is to obtain economic benefits. The purpose of arbitration parties in choosing international arbitration is to efficiently and conveniently resolve cross-border trade disputes. Due to the different arbitration purposes of the two parties mentioned above, conflicts and disputes may arise during the arbitration process. For example, parties under economic pressure may likely cooperate with funders, thereby compromising their own arbitration interests. Moreover, third-party funding agreements are inherently secretive, and arbitration institutions cannot timely understand the parties' situations and provide remedies. Therefore, based on the negative impact of third-party funding itself and its inherent secrecy, it is urgent to establish a disclosure system to protect the interests of the funded party.

Firstly, the third-party funding system is likely to restrict the parties from exercising the principle of party autonomy. Funders' investment in commercial arbitration tends to be profit-driven, and to achieve their goals, they may interfere with the parties' engagement of lawyers and the appointment of arbitrators. In this situation, the third party, by participating in the arbitration through the position of the funded party, to some extent undermines the autonomy of the parties involved The funding agreement, as a contract under party autonomy, needs to be complied with by the parties as long as it does not violate public order, good morals, laws, and regulations, or it may constitute a breach. However, in the process of formulating the agreement terms, parties may authorize their lawyers to appoint funders and design arbitration strategies due to financial constraints. In such circumstances, the motivations of the funder and the parties participating in the arbitration differ, but they ultimately converge, as both aim to win the award. However, if they disagree on mediation issues, the parties' interests may easily be compromised. For example, if a party wants to mediate with the other party during arbitration, but entering into mediation may reduce compensation fees and the funder's profits, the funder may obstruct the party's entry into mediation or even bring a breach of contract lawsuit to compel the party to continue arbitration.

Secondly, it may indirectly affect the normal operation of the arbitration process. As mentioned above, due to the secrecy of funding agreements and the inequality in the formulation of terms, third-party funders may likely force parties to participate in arbitration, thus manipulating the arbitration process. Such conduct not only affects the autonomy of the funded party but also directly impacts the proper functioning of the arbitration process. Moreover, the covert nature of the funding activity makes its negative effects even harder to eliminate. Therefore, it is imperative to establish a set of reasonable regulatory measures to prevent third-party funders from exerting control over international arbitration.

Finally, there may be conflicts of interest between arbitrators and third-party funders, affecting the fairness and impartiality of arbitration and undermining the credibility of the arbitration process. Unlike judges, arbitrators' identities are more complex and diverse. In both China and other countries, one of the significant sources of arbitrators is lawyers【1】. The conflicts of interest include: (1) arbitrators acting as advisors to funders; (2) arbitrators or the law firms where arbitrators are affiliated having regular relationships with third-party funders, or even symbiotic relationships; (3) the relationships between large law firms and major arbitrators in the industry;【2】 (4) close family members of arbitrators having significant economic interests in case outcomes.【3】

II. Regulations on Third-Party Funding Disclosure System in Commercial Arbitration in Different Regions

Many countries and arbitration institutions have regulations on third-party disclosure systems. This article will organize and summarize the third-party disclosure systems in Singapore, Hong Kong, and Chinese Mainland.

(I) Singapore's Arbitration Third-Party Funding Disclosure System

Regarding the regulation of third-party funding, Singapore has adopted a "light touch approach" favored by Australia, England, and Wales. It has enacted the Civil Law (Third-Party Funding) Regulations 2017, and Legal Profession (Professional Conduct) Rules 2015 to regulate third-party funding. Part 5A of the Legal Profession (Professional Conduct) Rules 2015 specifies the content of the obligation to disclose third-party funding. The subject of disclosure refers only to the legal practitioner; the disclosure is directed to the court or tribunal, and to every other party to those proceedings; the scope of disclosure includes the existence of any third-party funding contract related to the costs of those proceedings, the identity of the third-party funder, and whether the funder has agreed to bear the costs of proceeding(s); there are two points in time for disclosure: The disclosure must be made at the date of commencement of the dispute resolution proceedings where the third-party funding contract is entered into before the date of commencement of those proceedings; The disclosure must be made as soon as practicable after the third-party funding contract is entered into where the third-party funding contract is entered into on or after the date of commencement of the dispute resolution proceedings. It also specifies the conflict of interest for legal practitioner: legal practitioners must not directly or indirectly hold any shares or other ownership interests of third-party funders. A legal practitioner or a law practice must not receive any commission, fee or share of proceeds from the Third-Party Funder.【4】

In addition to legislation, INVESTMENT ARBITRATION RULES OF THE SINGAPORE INTERNATIONAL ARBITRATION CENTRE SIAC INVESTMENT ARBITRATION RULES (1ST EDITION, 1 JANUARY 2017) also make provisions for third-party funding. However, as this article is limited to international commercial arbitration, this rule is not discussed.

(II) Regulations on Third-Party Funding Disclosure System in Hong Kong

Consistent with Singapore, Hong Kong also adopts a "light touch" regulatory approach to the third-party funding disclosure system, which is reflected in both arbitration legislation and arbitration institution rules.

The legislation governing third-party funding includes the Arbitration and Mediation Legislation (Third Party Funding) (Amendment) Ordinance 2017 and A Code of Practice for Third Party Funding of Arbitration. The Arbitration and Mediation Legislation (Third Party Funding) (Amendment) Ordinance 2017 recognizes the legality of third-party funding. A Code of Practice for Third Party Funding of Arbitration stipulates the code of conduct and standards for third-party funding. The Arbitration and Mediation Legislation (Third Party Funding) (Amendment) Ordinance 2017 primarily provide for disclosure obligations under sections 98U (Disclosure about third party funding of arbitration) and 98V (Disclosure about end of third party funding of arbitration). Section 98U specifies that the parties must give written notice of the fact that a funding agreement has been made, and the name of the third party funder to each other party to the arbitration and the arbitration body. The notice must be given for a funding agreement made on or before the commencement of the arbitration on the commencement of the arbitration; or for a funding agreement made after the commencement of the arbitration-within commencement 15 days after the funding agreement is made. Section 98V further stipulates that if a funding agreement ends, other than due to the conclusion of the arbitration, the funded party must give written notice of the termination and the date of termination within 15 days of the agreement ending. This notice must be provided to all other parties to the arbitration and the arbitration body.【5】

A Code of Practice for Third Party Funding of Arbitration stipulates the obligation to disclose in section 2.10, indicating that funders must disclose in accordance with the provisions of sections 98U and 98V except as required by the funding agreement, or as ordered by the arbitration body in an arbitration, or as otherwise required by law.【6】

The arbitration rules regulating the obligation to disclose third-party funding mainly refer to Article 44 of the Hong Kong International Arbitration Centre Administered Arbitration Rules 2018 (2018 HKIAC Administered Arbitration Rules). The HKIAC Administered Arbitration Rules acknowledges the legality of third-party funding arbitration and provide specific provisions on the disclosure obligations of funders and funded parties, the confidentiality obligations of the arbitration process, and the allocation of arbitration costs. Mainly including: Firstly, the funded party must actively disclose the fact that a funding agreement has been made and the identity of the third party funder, and promptly update and publish such disclosure items; Secondly, to ensure the stability of the funded party's funding, it allows the funded party to disclose case-related information to the funder outside the confidentiality obligation of arbitration, safeguarding the funder's basic right to information; Thirdly, it gives the arbitral tribunal greater discretion to solve the complex issue of cost allocation caused by the existence of third-party funding.【7】

(III) Regulations on Obligation of Third-Party Funding Disclosure in Chinese mainland

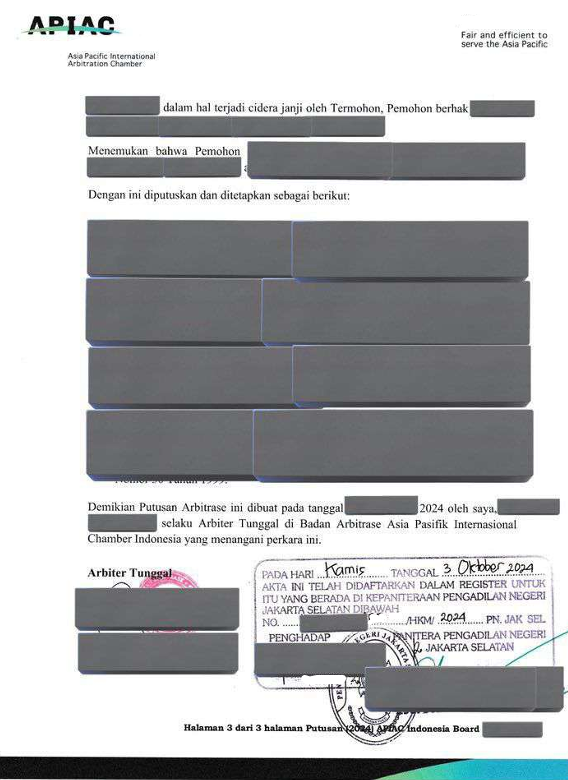

Chinese mainland has not made specific regulations on the disclosure of third-party funding in legislation. Therefore, the relevant provisions of the China International Economic and Trade Arbitration Commission (CIETAC) and the Asia Pacific International Arbitration Chamber (APIAC) are summarized.

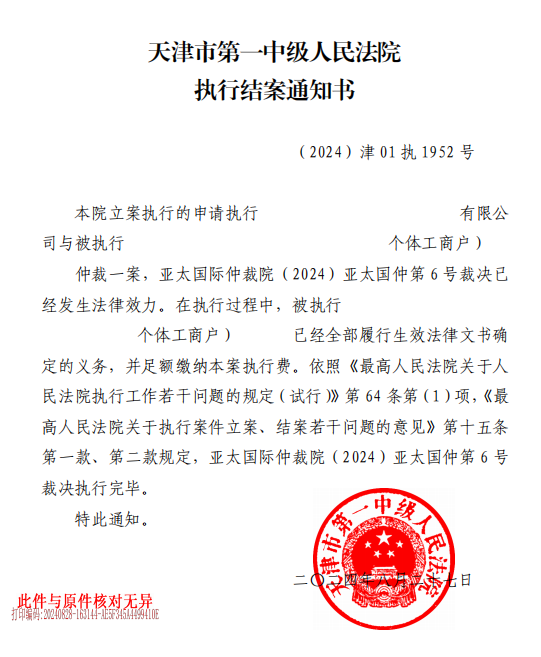

CIETAC's regulations on the obligation of third-party funding disclosure are stipulated in Article 48 of CIETAC arbitration rules. Specifically, Once a third party funding agreement is concluded, the funded party shall communicate to the Arbitration Court, without any delay, the existence of the third party funding arrangement, the financial interest therein, the name and address of the third party funder and other relevant information. The Arbitration Court shall forward such information to the other parties and the arbitral tribunal. The arbitral tribunal may order the funded party to disclose other relevant information of the funding if it deems necessary.【8】

APIAC's regulations on the obligation of third-party funding disclosure are stipulated in Article 46 of its arbitration rules. It states that When a party receiving third-party funding signs the funding agreement, the funded party shall submit sufficient copies of the written notice regarding third-party funding to the Secretariat. The Secretariat shall serve the information on third-party funding to he other parties and the Tribunal (if already appointed) as soon as practicable. The information includes: (a)The fact that a funding agreement has been entered into; (b) The name, address, contact number or e-mail of the third party funder. Upon request by the other party and the Tribunal agrees, or if the Tribunal deems it necessary, the party receiving third-party funding may be required to disclose further relevant information.【9】

Both of the above arbitration institutions specify that the party receiving third-party funding is the main subject of the disclosure obligation, while also giving the arbitral tribunal discretionary power to determine the necessity of disclosure.

III.Practice of Third-Party Funding Disclosure System

In practice, the third-party funding disclosure system is often associated with issues of arbitrator conflicts of interest and arbitration confidentiality principles. This section will illustrate the practical application of the third-party funding disclosure system through a case.

The case involves Ruili Airlines Co., Ltd., Yunnan Jingcheng Co., Ltd., and Dong Lecheng requesting court to set aside the arbitration award (hereinafter referred to as the "Award") rendered by the China International Economic and Trade Arbitration Commission (CIETAC) under CIETACBJ Award No. 3192 in 2021. There are two main points of dispute related to third-party funding.

(I) The conflict of interest between the arbitrator and the funder

The applicants argue that during the arbitration period, Arbitrator A's firm, Nixon Peabody CWL, had business dealings with HSBC Custody Nominees (Australia) Limited and JP Morgan Nominees Australia Limited, the two major shareholders of the third-party funder IMF Bentham Limited for CDB Aircraft Leasing (Tianjin) Co..Since the third-party funder in question is a for-profit enterprise that seeks returns based on the potential economic value of the arbitration claim, the outcome of the arbitration case will directly affect the profitability of the third-party funder. Therefore, the firm where Arbitrator A is employed during the arbitration period has significant interests aligned with the third-party funder, and this fact should fall within the scope of the arbitrator's disclosure obligations.

The respondent argues that Arbitrator A does not have any significant undisclosed interests and has not failed to recuse where required, and that the composition of the arbitral tribunal complies with the arbitration rules. Firstly, HSBC Custody Nominees (Australia) Limited and JP Morgan Nominees Australia Limited are merely securities custodian entities and not "major shareholders" of IMF. Secondly, Nixon Peabody CWL, where Arbitrator A is employed, is a Hong Kong general partnership law firm formed in 2015 through a merger between CWL Partners and the Hong Kong office of Nixon Peabody LLP, operating independently from Nixon Peabody LLP at a legal level, despite using the "Nixon Peabody" name. The allegations made by Ruili Airlines Co., Ltd., Yunnan Jingcheng Co., Ltd., and Dong Lecheng that Arbitrator A failed to disclose and recuse as required by the arbitration rules are unsubstantiated both factually and legally and therefore cannot be sustained.

Finally, The Beijing No. 4 Intermediate People's Court of the People's Republic of China (hereinafter refer to as “the Fourth Intermediate People's Court”)holds that the existing associational relationships in social life and interactions, not meeting the legal threshold to affect the independent and impartial conduct and award of the arbitration, and where the arbitrator should not have been aware of such relationships, do not establish a violation of the arbitrator's duty to disclose information, nor a breach of recusal procedural requirements. Upon review, the current evidence in this case is insufficient to demonstrate that Arbitrator A has a conflict of interest with the third-party funding entity involved in the case, and there is no situation where, as per arbitration law or rules, there should have been a recusal that did not occur, potentially affecting a fair decision. Arbitrator A has fulfilled their disclosure obligations as per Articles 31 and 32 of the CIETAC arbitration rules, and the current evidence is also insufficient to establish any facts or circumstances that could reasonably cast doubt on their impartiality and independence concerning the third-party funding entity involved in the case.

(II) Regarding whether third-party funding itself violates the confidentiality principle of arbitration

The applicant contends that the involvement of a third-party funding entity in the arbitration, being privy to the substance and procedures of the case, may, due to the public nature of a listed company, potentially involve disclosure of the case outcome. CDB Aircraft Leasing (Tianjin) Co. and the arbitral tribunal have breached the confidentiality principle of arbitration, warranting the annulment of the award.

The respondent argues that the participation of the third-party funding entity in the arbitration by CDB Aircraft Leasing (Tianjin) Co. and the arbitral tribunal does not contravene the confidentiality principle of arbitration or arbitration rules, and there are no statutory grounds for an award annulment. The third-party funding agreement includes confidentiality clauses, meeting the requirements of arbitration confidentiality. CDB Aircraft Leasing (Tianjin) Co. has proactively disclosed the existence of third-party funding to the arbitral tribunal for the arbitrator and other relevant individuals to access. CDB Aircraft Leasing (Tianjin) Co. is not obliged to disclose, and the arbitral tribunal is not obliged to request disclosure of the funding agreement or require a confidentiality commitment from the involved third-party funding entity.

The Fourth Intermediate People's Court believes that the essence of arbitration confidentiality lies in the non-disclosure of case details to the public to safeguard the commercial secrets and public image of the parties, and the arbitration rules do not permit the disclosure of information to the "outside world," although it does not restrict the knowledge of relevant individuals. In practice, apart from the explicitly specified individuals in the arbitration rules, there are other relevant individuals who may be aware of the case details without breaching the confidentiality provisions, such as decision-makers of the corporate party in arbitration, significant shareholders, corporate legal personnel, and the tribunal's secretary. The intention of arbitration confidentiality is to keep arbitration cases undisclosed to the public, minimizing their exposure to a wider audience. As the existing arbitration rules do not prohibit third-party funding entities from supporting parties in arbitration, establishing a funding relationship between a third-party funding entity and a party does not violate arbitration confidentiality rules. The current evidence in this case is also insufficient to prove a breach of confidentiality rules leading to the public disclosure of case substance and procedures.

Regarding the choice of arbitration by legal entities and the selection of third-party funding during arbitration, these actions should be judged based on legal grounds and the principle of party autonomy. On one hand, legal entities have the right to access quality legal services to protect their legitimate interests. On the other hand, when legal entities choose arbitration as a dispute resolution method, they also have the right to engage in agreements with third-party funders. Whether opting for arbitration to settle disputes or selecting third-party funding, these fall within the scope of legal entities exercising their rights lawfully. When such actions do not violate the law or compromise the fairness of arbitration rulings, they reflect the legitimate choices of legal entities based on their autonomy. CDB Aircraft Leasing (Tianjin) Co. has voluntarily disclosed the involvement of a third-party funding entity to the arbitral tribunal. Although there are currently no specific regulations for disclosing third-party funding, publicly disclosing the involvement of third-party funding during the arbitration process benefits the arbitral tribunal and all parties by ensuring access to information and the exercise of related rights based on disclosed information. The funding actions of the third-party funding entity in this case do not contravene existing laws and arbitration rules, nor do they affect the fairness of the case ruling, thus not constituting statutory grounds for annulling the arbitration award.

In conclusion, the Fourth Intermediate People's Court adopts a relatively open and supportive stance towards third-party funding, considering the selection of third-party funding by parties falls within the realm of party autonomy. In this case, as there is no legal prohibition against third-party funding and the parties have disclosed the existence and information of the funder, and the applicant lacks sufficient evidence to prove any conflicts of interest between the arbitrator and themselves or to demonstrate that the third party disclosed information to external parties, the third-party funding in question is deemed lawful and valid.

Conclusion

Third-party funding has transitioned from being illegal to legal, becoming an important rule in international commercial arbitration, gradually entering the mainstream and being widely utilized. The third-party funding system effectively addresses the high costs associated with international commercial arbitration, providing parties with a path closer to justice. However, its secrecy and profit-seeking nature pose challenges to the fairness and reasonableness of international commercial arbitration. Therefore, there is a need for disclosure rules to restrict third-party funding, promote the healthy development of the third-party funding system, safeguard the interests of the parties, maintain the fairness of arbitration, and propel the international arbitration industry towards new heights.

Note:

【1】Research on the Disclosure Rule in Commercial Arbitration Funded by A Third Party ,DingHantao, WUHAN UNIVERSITY INTERNATIONAL LAW REVIEW,2016(2)

【2】REPORT OF THE ICCA-QUEENMARY TASK FORCE ON THIRD-PARTY FUNDING ININTERNATIONAL ARBITRATION,April 2018,THE ICCA REPORTS NO.4,p.82.

【3】IBA Guidelines on Conflicts of Interests in International Arbitration,article2.2.2.

【4】Legal Profession (Professional Conduct) Rules 2015

【5】The Arbitration and Mediation Legislation (Third Party Funding) (Amendment) Ordinance 2017 ,https://www.gld.gov.hk/egazette/pdf/20172125/cs1201721256.pdf

【6】A Code of Practice for Third Party Funding of Arbitration,https://www.gld.gov.hk/egazette/pdf/20182249/cgn201822499048.pdf

【7】Hong Kong International Arbitration Centre Administered Arbitration Rules 2018 (2018 HKIAC Administered Arbitration Rules),https://www.hkiac.org/sites/default/files/ck_filebrowser/PDF/arbitration/2018%20Rules%20book/2018%20AA%20Rules_Simplified_web%20%28saved%20in%202019%20May%29.pdf

【8】CIETAC Arbitration Rules (2024 Edition),http://cietac.org.cn/index.php?m=Page&a=index&id=14

【9】Arbitration Rules of the Asia Pacific International Arbitration Chamber,https://apiac.sg/page/cn/regulation

news

-

2023-09-21 02:01:59

2023-09-21 02:01:59 -

2023-09-21 02:01:59

2023-09-21 02:01:59 -

2023-09-26 14:22:56

2023-09-26 14:22:56 -

2023-10-07 08:34:26

2023-10-07 08:34:26 -

2023-10-13 11:08:58

2023-10-13 11:08:58 -

2023-10-25 10:30:58

2023-10-25 10:30:58 -

2023-10-25 11:08:40

2023-10-25 11:08:40 -

2023-11-22 14:57:27

-

2023-11-24 16:06:15

2023-11-24 16:06:15 -

2023-11-24 17:34:06

2023-11-24 17:34:06 -

.jpg) 2023-11-27 11:07:53

2023-11-27 11:07:53 -

.png) 2023-12-07 11:34:06

2023-12-07 11:34:06 -

2023-12-19 09:18:51

2023-12-19 09:18:51 -

2023-12-19 11:38:23

2023-12-19 11:38:23 -

2023-12-19 11:53:22

2023-12-19 11:53:22 -

2023-12-19 14:46:19

2023-12-19 14:46:19 -

2023-12-21 14:43:26

2023-12-21 14:43:26 -

2023-12-25 11:04:59

2023-12-25 11:04:59 -

2023-12-27 10:40:15

2023-12-27 10:40:15 -

.png) 2023-12-29 14:07:14

2023-12-29 14:07:14 -

.jpg) 2023-12-29 14:10:32

2023-12-29 14:10:32 -

2024-01-03 16:27:17

2024-01-03 16:27:17 -

2024-01-12 10:36:42

2024-01-12 10:36:42 -

2024-01-17 15:01:24

2024-01-17 15:01:24 -

2024-01-30 10:10:28

2024-01-30 10:10:28 -

2024-01-30 10:45:10

2024-01-30 10:45:10 -

2024-01-30 15:47:05

2024-01-30 15:47:05 -

2024-01-30 16:10:56

2024-01-30 16:10:56 -

2024-02-21 10:01:34

2024-02-21 10:01:34 -

2024-02-21 10:05:01

2024-02-21 10:05:01 -

2024-02-21 10:35:10

2024-02-21 10:35:10 -

2024-03-08 17:37:59

-

2024-03-11 08:56:10

2024-03-11 08:56:10 -

2024-03-22 14:24:24

2024-03-22 14:24:24 -

2024-03-26 13:21:28

2024-03-26 13:21:28 -

2024-03-27 11:38:36

-

2024-03-27 11:43:15

2024-03-27 11:43:15 -

2024-03-28 16:56:51

-

2024-04-01 14:59:03

2024-04-01 14:59:03 -

2024-04-09 10:46:25

2024-04-09 10:46:25 -

2024-04-09 11:55:48

-

2024-04-09 16:01:04

2024-04-09 16:01:04 -

2024-04-15 16:34:57

-

2024-04-15 16:43:36

-

2024-04-18 16:34:31

-

2024-04-24 16:02:32

-

2024-04-25 17:26:30

-

2024-05-07 16:30:51

-

2024-05-11 14:54:18

-

2024-05-20 17:00:26

-

2024-05-31 16:19:03

-

2024-05-31 16:41:28

2024-05-31 16:41:28 -

2024-05-31 16:53:49

-

2024-06-03 17:06:33

-

2024-06-19 16:45:08

2024-06-19 16:45:08 -

2024-06-24 11:44:37

2024-06-24 11:44:37 -

2024-06-24 17:56:13

2024-06-24 17:56:13 -

(1).png) 2024-06-25 15:34:49

2024-06-25 15:34:49 -

(1)(1).png) 2024-06-25 15:41:16

2024-06-25 15:41:16 -

.png) 2024-06-28 10:09:40

2024-06-28 10:09:40 -

2024-07-03 14:33:07

2024-07-03 14:33:07 -

.png) 2024-07-03 14:53:48

2024-07-03 14:53:48 -

2024-07-04 16:52:21

2024-07-04 16:52:21 -

2024-07-09 09:31:59

2024-07-09 09:31:59 -

受邀参加“中资企业印尼投资法律论坛”(1).png) 2024-07-12 09:22:59

2024-07-12 09:22:59 -

.png) 2024-07-16 09:36:49

2024-07-16 09:36:49 -

.png) 2024-07-16 11:37:03

2024-07-16 11:37:03 -

2024-07-19 10:43:08

2024-07-19 10:43:08 -

.png) 2024-07-22 10:59:23

2024-07-22 10:59:23 -

2024-07-23 09:31:20

2024-07-23 09:31:20 -

.png) 2024-07-23 14:12:58

2024-07-23 14:12:58 -

.png) 2024-08-19 09:19:47

2024-08-19 09:19:47 -

.png) 2024-08-19 10:28:22

2024-08-19 10:28:22 -

2024-08-29 10:12:54

2024-08-29 10:12:54 -

2024-09-03 17:10:04

2024-09-03 17:10:04 -

.png) 2024-09-04 11:52:59

2024-09-04 11:52:59 -

) 2024-09-05 10:17:01

2024-09-05 10:17:01 -

.png) 2024-09-09 14:35:19

2024-09-09 14:35:19 -

2024-09-09 15:10:13

2024-09-09 15:10:13 -

2024-09-10 10:49:03

2024-09-10 10:49:03 -

.png) 2024-09-14 14:22:46

2024-09-14 14:22:46 -

.png) 2024-09-14 15:38:09

2024-09-14 15:38:09 -

2024-09-18 11:33:35

2024-09-18 11:33:35 -

.png) 2024-09-18 14:26:08

2024-09-18 14:26:08 -

(1).png) 2024-09-23 16:07:22

2024-09-23 16:07:22 -

.png) 2024-09-23 16:17:09

2024-09-23 16:17:09 -

.jpg) 2024-09-23 17:08:06

2024-09-23 17:08:06 -

2024-09-24 09:48:07

2024-09-24 09:48:07 -

2024-09-24 12:00:38

2024-09-24 12:00:38 -

2024-09-24 15:13:56

2024-09-24 15:13:56 -

2024-09-25 16:06:59

2024-09-25 16:06:59 -

2024-09-27 16:32:47

2024-09-27 16:32:47 -

2024-09-29 16:35:43

2024-09-29 16:35:43 -

2024-10-09 09:38:56

2024-10-09 09:38:56 -

2024-10-10 15:40:31

2024-10-10 15:40:31 -

2024-10-11 15:13:22

2024-10-11 15:13:22 -

2024-10-23 17:08:52

2024-10-23 17:08:52 -

2024-10-23 17:10:37

2024-10-23 17:10:37 -

2024-10-23 17:12:12

2024-10-23 17:12:12 -

2024-10-24 12:36:20

2024-10-24 12:36:20 -

2024-10-29 15:45:32

2024-10-29 15:45:32 -

2024-11-01 16:45:33

2024-11-01 16:45:33 -

2024-11-01 16:50:15

2024-11-01 16:50:15 -

2024-11-01 18:07:18

2024-11-01 18:07:18 -

2024-11-05 15:44:55

2024-11-05 15:44:55 -

2024-11-05 15:53:12

2024-11-05 15:53:12

CN

CN BI

BI